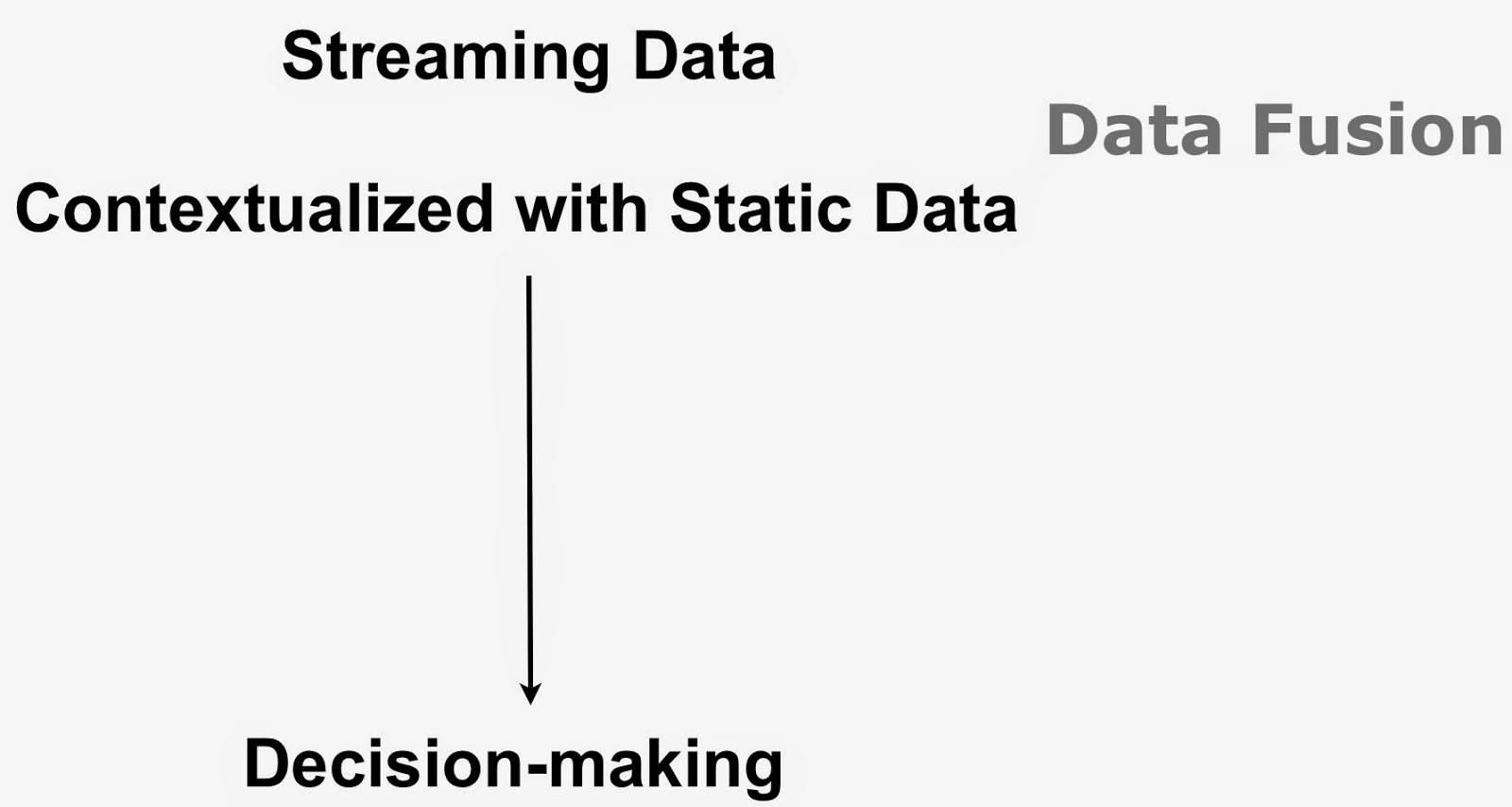

As much as I love talking about general-purpose big data platforms and data science frameworks, I’m the first to admit that many of the interesting startups I talk to are focused on specific verticals. At their core big data applications merge large amounts of real-time and static data to improve decision-making:

This simple idea can be hard to execute in practice (think volume, variety, velocity). Unlocking value from disparate data sources entails some familiarity with domain-specific1 data sources, requirements, and business problems.

It’s difficult enough to solve a specific problem, let alone a generic one. Consider the case of Guavus – a successful startup that builds big data solutions for the telecom industry (“communication service providers”). Its founder was very familiar with the data sources in telecom, and knew the types of applications that would resonate within that industry. Once they solve one set of problems for a telecom company (network optimization), they quickly leverage the same systems to solve others (marketing analytics).

This ability to address a variety of problems stems from Guavus’ deep familiarity with data and problems in telecom. In contrast, a typical general-purpose platform can come across as a hammer in search of a nail. So while I remain a fan (and user) of general-purpose platforms, the less well-known verticalized solutions are definitely on my radar.

Better tools can’t overcome poor analysis

I’m not suggesting that the criticisms raised against big data don’t apply to verticalized solutions. But many problems are due to poor analysis and not the underlying tools. A few of the more common criticisms arise from analyzing correlations: correlation is not causation, correlations are dynamic and can sometimes change drastically2, and data dredging3.

Related Content:

- The backlash against big data, continued

- The CFP for Strata New York + Hadoop World 2014 is now open!

- Strata Santa Clara 2014 Video Compilation

- Financial analytics as a service

(0) This post grew out of a recent conversation with Guavus founder, Anukool Lakhina.

(1) General-purpose platforms and components are helpful, but they usually need to be “tweaked” or “optimized” to solve problems in a variety of domains.

(2) When I started working as a quant at a hedge fund, traders always warned me that correlations jump to 1 during market panics.

(3) The best example comes from finance and involves the S&P 500 and butter production in Bangladesh.