In “HP’s Tortured WebOS Positioning,” Jean-Louis Gassée makes the assertion that the consumerization of IT renders the “enterprise-only” pivot null and void.

In “HP’s Tortured WebOS Positioning,” Jean-Louis Gassée makes the assertion that the consumerization of IT renders the “enterprise-only” pivot null and void.

I disagree, but first some clarity for those who aren’t familiar with the term “consumerization of IT.”

When the enterprise lost its mojo

Once upon a time, large enterprises (think: Fortune 2000 companies) were widely perceived to be the ideal customer, owing to their large size, well-defined and massive IT budgets, wide range of solution needs, and target-ability from a sales perspective.

All sorts of hardware, software, hosted services and consulting services companies — not to mention a significant chunk of the venture capital industry — fed off of this massive ecosystem, the impact of which meant that innovation began in the enterprise, and then trickled down to the consumer.

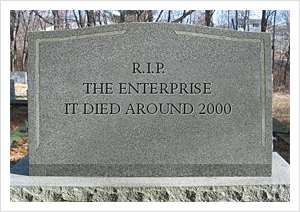

However, when the dotcom bubble blew up at the end of 2000, coinciding with the end of the over-hyped Y2K project “pig trough,” enterprises lost the impetus to spend aggressively on IT.

In parallel, they began to (rightly) question the return on investment for the many projects they had funded. In broad terms, this led to a reclassification of IT from being a strategic asset, and core differentiator, to being a liability, and a necessary evil.

Basically, the CFO trumped the CIO going forward.

The neutering of the enterprise from an IT perspective coincided almost perfectly with the second coming of a consumer-focused Apple (which frankly, has never grokked the enterprise).

Now suddenly innovation began originating in the consumer realm, and then trickling to the enterprise after it was proven to be a safe investment.

Web 2.0 Summit, being held October 17-19 in San Francisco, will examine “The Data Frame” — focusing on the impact of data in today’s networked economy.

Web 2.0 Summit, being held October 17-19 in San Francisco, will examine “The Data Frame” — focusing on the impact of data in today’s networked economy.

Is the enterprise dead as a player in tablet devices?

Call me naive, but speaking from the perspective of an iOS developer (and someone who used to sell a bunch of hardware and software solutions to enterprises), I think an opportunity exists for some tablet maker to penetrate the enterprise.

Why? Apple’s model of controlling both the value-add hardware channel and the software distribution channel is a decided anathema to enterprises, which typically prefer working with and through VAR channels (i.e., Value-Added Resellers) and System Integrators (SI).

Similarly to VARs and SIs, the Apple model heavily complicates the types of solutions that vendors can provide, the pricing that vendors can achieve, the ability to not broadcast key customers to competitors, and the like.

And don’t even get me started on Android as an alternative. Here, Google’s focus on free, loosely-coupled, “good enough” and ad-supported is a distinctly different set of sales and support assumptions than the enterprise, which is all about high-touch, custom and deeply integrated, has come to expect.

Thus, in the bigger picture the open questions are two-fold. One, is whether there exists a vendor in the tablet space other than Apple that is going to properly set and meet market expectations, as opposed to perennially over-promising, and under-delivering.

This, of course, requires an actual product discipline, inclusive of coherent evangelism, a clear roadmap and release strategy, and a culture of focused execution and iteration — especially on the software side of the equation.

Here, the litmus test is actually kind of easy. Until one of these manufacturers stops talking about Adobe’s Flash as a feature (versus a bug, until it works caveat-free); or touting Snapdragon processors and their clock speeds (customers buy outcomes, not attributes), Apple is going to remain the only credible player in tablets.

There is just too much of a halo effect working to Apple’s advantage, and the company has high execution credibility in this domain.

By contrast, RIM, the long-time enterprise leader of mobile devices, has clearly (so far) screwed the pooch with their confused PlayBook strategy. And Gassée’s piece covers HP’s early tablet missteps.

Attacking undefended hills

HP, IBM, Oracle and Microsoft all have logical entry points, from a solutions perspective, into the enterprise via tablet computing. But they must get focus and religion on attacking the “undefended hill” (to use an HP axiom) that is the enterprise tablet.

Simply put, no one is credibly focusing on this customer and its surrounding eco-channel.

Which brings me to the second question: Does there exist even one enterprise with sufficient vision to be “greedy” from an investment and innovation perspective while every one of their peers is acting scared (to use a Warren Buffett axiom)?

After all, it only take one serious proof point to ignite a market, and if HP, et al are really serious, proving out the enterprise should be a core focus.

Netting it out: It’s too early to proclaim game over when the stakes are measured in the billions of devices, the budgets are measured in the billions of dollars, and a sleeping gorilla lies naked, unfed and uncared for in the enterprise.

Related: